WeBull vs Acorns – A Comparison & Look at their Differences

Lets take a Deep Dive into the differences between these two Investing Platforms

DigitalConsumer.org has the resources, staff, expertise and background to help people make informed financial decisions and choices. We've pooled our 25 yrs of combined experiences to ensure we can bring you the most unbiased, well informed content on the internet to help you make the right choices when looking to better your life.

DigitalConsumer.org adheres by strict editorial guidelines - Our readers can rest assured that we’re putting their interests as our top priority. Our articles and content is reviewed and written by industry professionals and edited by qualified subject matter experts, who further ensure all content or topics we publish is accurate, unbiased and trustworthy.

Our skilled contributors and reviewers emphasis their research and data analysis to align with what our readers want and need to learn more about - This includes (but is not limited too) making money on the side, finding information about retailers & online stores, how to earn income on the side and many other subjects of this nature. We strive to help everyone feel confident with their decisions and endeavors.

DigitalConsumer.org adheres by strict editorial guidelines - Our readers can rest assured that we’re putting their interests as our top priority. Our articles and content is reviewed and written by industry professionals and edited by qualified subject matter experts, who further ensure all content or topics we publish is accurate, unbiased and trustworthy.

Our Mission & Principles

We take pride in making it our mission to provide authentic, accurate and unbiased content, articles and data analysis of products and services for our readers. We've set high editorial standards to ensure that we meet and exceed the expectations of adding value to our readers' lives through our recommendations, reviews, comparisons and information. Our review and editorial board fact-checks all content maintain accuracy and integrity before our content is published to uphold our editorial standards. In order to not influence our editorials and contributor teams, we ensure that our contributors and editorial teams do not receive compensation directly from our advertisers.

Editorial Independence

DigitalConsumer’s contributor team and review board has one goal - To give our readers the most unbiased and honest advice to assist in making personal finance choices and decisions - Whether you're looking for services and apps to make extra cash on the side or finding a retailer or business to work with. We've enforced strict editorial guidelines to ensure that information and content presented to our readers on our website is not influenced by our advertisers. As mentioned above, our team of writers, contributors and editors receive no direct compensation from our advertisers, and our articles, content and reviews is properly fact-checked to ensure 100% accuracy.

Our expert team of contributors, writers and review board have a combined experience of over 25 yrs in business, finance and retail. We pride ourselves in helping our readers stay informed on consumer finance, business and retail information.

DigitalConsumer.org adheres and follows strict editorial guidelines, to ensure our readers can trust that our articles, content and reviews are unbiased, accurate and trustworthy.

Digitalconsumer.org is Independently owned, advertising-supported publisher and comparison internet service. We are compensated from advertisers to place ads (in-content, sidebar, and header ads)or by you clicking on affiliate links posted on our website. This compensation may impact where, how and in which order products are listed within categories or in our content. While we continually update and strive to showcase a wide variety products, services and offers, DigitalConsumer.org does not include content or info about every Product, retailer, service or app.

In recent years there has been a huge increase in trading and investment apps available online that has made even choosing the best one quite difficult.

With all of these new and diverse trading apps that are recently gaining attention, it’s a good idea to familiarize yourself with the kind of investing app you’re trying to use.

I this article, we are going to review two of the best recently booming trading apps which are Webull and Acorns.

Both of these applications are great options but there are key differences between the two that you might want to know before making a decision.

Webull is a stock investing app that offers different services with advanced mechanisms and very useful features that are free of commission.

Acorns, on the other hand, is a round-up change app that allows you to save and invest money at the same time.

However, the biggest difference between these two is the investment strategy.

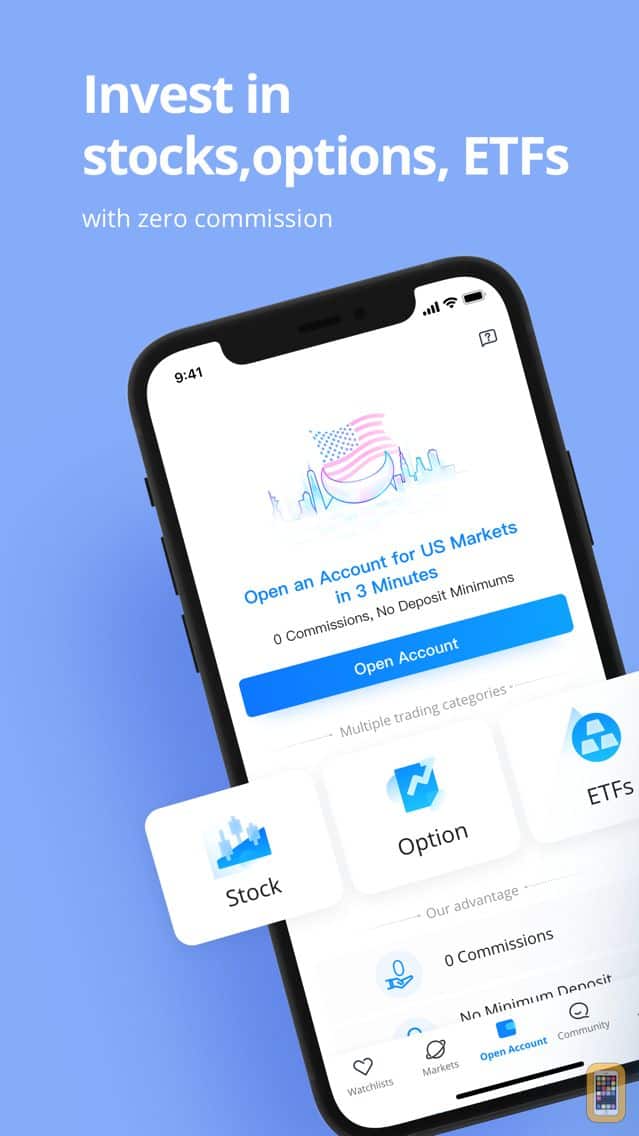

What Is Webull?

Webull is an investment app that offers commission-free stock trading and exchange-traded funds with a lot of other offers such as short selling.

This app has zero commissions, which is becoming a trend among other apps, as well as having no contract fees.

Having zero commissions and no contract fees can really save you money in the long run.

It’s easy to use with basic and advanced features, so even if you’re a beginner in investing stocks, you can still use this app.

Webull features:

- Technical indicators: the app has 22 technical indicators available including relative strength indices, moving averages, etc.

- Virtual Trading simulator: this feature allows you to make virtual portfolios with fake money to experiment on different strategies before the actual trading. This is very helpful to people who are still starting up their investments to gain more knowledge before risking investing real money.

- Smart Alerts: this feature enables notifications sent to you so you’ll be kept updated with different investment news. For example, when a price you’ve been aiming for has been posted you can immediately know because Webull provides alerts to inform you faster.

- Financial Calendar: Even a normal calendar is very important to everyone. In the case of investors, financial calendars are one of the most important things in stock trading. The financial calendar updates you with current relevant trading news like dividend payouts, IPOs, earnings, etc.

- Margin Trading: This feature is only available for investors with a minimum account balance of $2,000. So investors that have a lesser balance than that can’t access this feature.

- After-hours trading: after-hours trading and pre-market trading allow investors to have flexibility in placing their stock trades from 4 am to 8 pm.

- Commission Free Short Selling: Short selling trades have no commissions but this feature is only available in a margin account, so not everyone can access this. However, all other trades are free.

Webull is best suited for people who like active trading with more focus on investment research.

This app has various features that can be used by investment researchers, technical or fundamental.

Usually, this app is mostly used by investors with a background in investment or those with prior investment experience.

Since this app has so many good features, it may cause confusion by so much research materials to newly made investors.

However, if you are an experienced investor or a newbie that takes risks, you might want to download this app via this link.

When you download the app, sign up for your account and they will give you 2 free stocks.

What is Acorns?

Acorns is an online app that can help you save money and invest at the same time.

Acorns has a round-up spare change option that increases your savings.

The extra cash from your savings will be automatically invested in your account.

This app is beginner-friendly so newbies on investments/stock trading can use this without problems, especially those who want to invest but struggle in saving.

Unlike Webull that is free, Acorns charges $1 to $3 every month, depending on your choice.

Acorn Features

- Acorn Spend: This feature imitates the function of a debit card. This checks your money while saving and investing it for you. But you have to pay $3/month for this feature.

- Acorns Later: inclusions for these features are Individual Retirement Accounts that save up money in the long term and many other

- Acorns Earn: When using this feature, you can save up money by purchasing items from Acorns’ partner retail shops like Nike, Apple, Airbnb, etc.

- Acorns Grow: This feature helps you gain more information on investments and help you know more about personal finance and other things related to stock trading.

Acorns Fees

Acorns has a lite version, Acorns Lite, that has a rate of $1 per month that can be used for 1 individual investment account.

However, if you want to have more accounts, try Acorns Personal, which charges $3 per month that includes a retirement account and Acorns Spend.

Investment inclusions

Acorns has a specific account that allows you to access only the features of that specific investment.

When you create an account, the app asks you a lot of questions that will bring you to a specific investment that you want to do.

There are 5 total investments that Acorns cater to; long-term investment, short-term investment, major purchase, children, general.

Once you’ve made up your mind on what step to take, the app will give you a probable portfolio that is suited for the investment plan you’re going for.

This portfolio follows the stock/bond portfolio allocation which means that the percentage of your stocks depends on your age.

The stock percentage is equal to 100 minus your age.

For example, if you are in your mid-thirties or 35 years old, you minus that age from 100 which gives you 65.

So the total stock percentage you can get is 65%. The remaining percentage will be allocated as your bond percentage.

There are two types of portfolios to go to aside from deciding based on your age.

There are conservative and aggressive portfolios.

Conservative portfolios often have a higher bond percentage which makes it less risky, while aggressive portfolios have more stocks that will give higher earnings but are riskier.

Aside from these features discussed, Acorns also offers ETFs in their app.

Acorns is best suited to newbie investors who prefer saving and investing for a long time.

Acorns are best at micro-savings that most investors use.

When you save up money over time, you get to have more in the future, so Acorns are really good in that part.

But when you’re an investor who does schedule deposits then this feature might not be helpful to you.

Acorns offer pre-made portfolios that cannot be customized and don’t allow portfolios for individual stocks.

However, if you’re interested in trying investing in this app or want to know more about their services, try visiting this link.

Webull vs Acorns

Both investing apps are great but the difference in strategies divides the people’s interests.

The different services make up for different types of investors which is good.

So, the question of which is the better app depends on what kind of investment you’re aiming for or what type of services are best suited for you.

If you’re an experienced investor that prefers active trading and individual investments, then Webull is the best choice for you.

On the other hand, if you’re a beginner and want to gain more knowledge on investing stocks, then you should try Acorns.

Webull and Acorns cater to different audiences so it is hard to rank both of them.